Welcome to the first Short Book Notes newsletter. Our aim is to bring you interesting tidbits related to short selling in Australian stocks and / or about the recent travails of Australian short sellers.

We hope you find it interesting and we would love to hear from you about how these could be improved going forward.

We will aim to publish on a weekly basis and would appreciate your contributions.

This week we cover:

CCX

KGN

EML

ZIP

John Hempton vs Tony Boyd (again)

Some other bits from around the traps

An April for the (offshore focused) bears

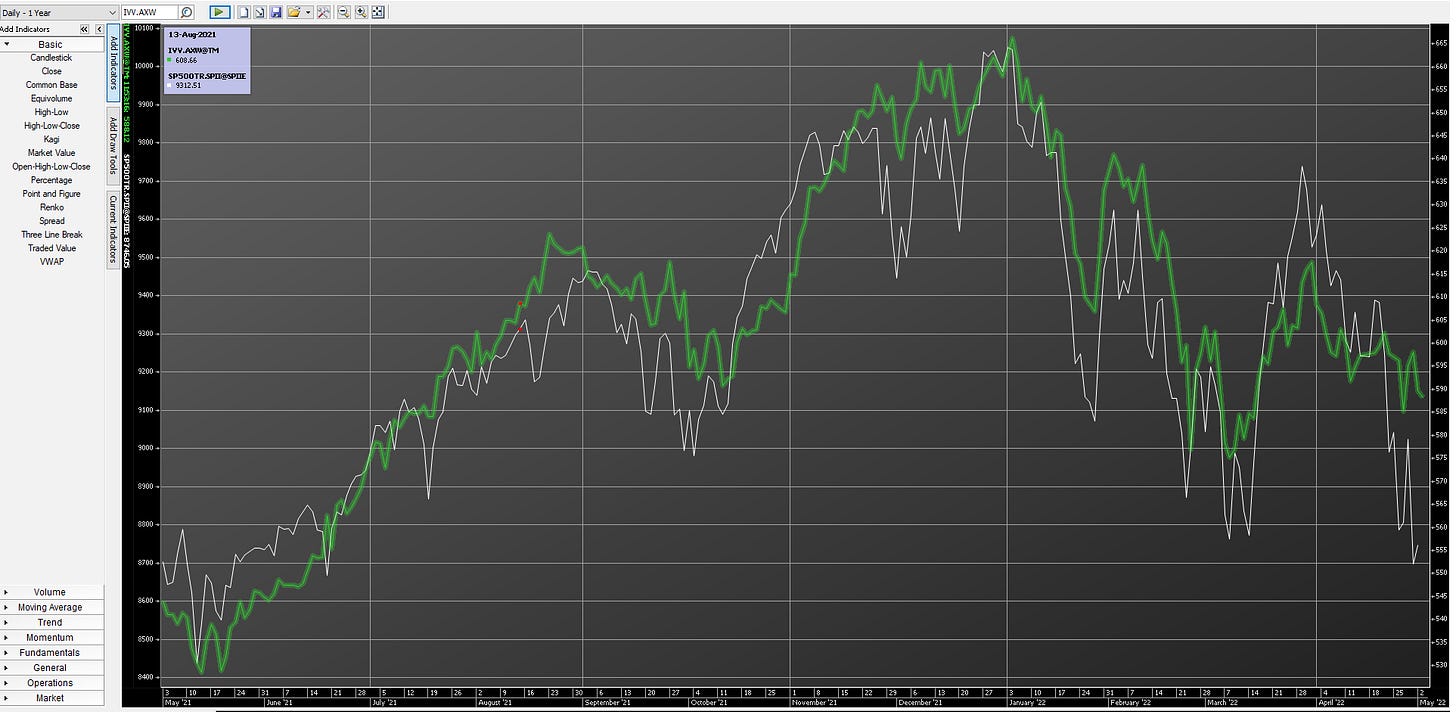

At an index level at least. In AU$ the S&P 500 Total Return index was down around 3% for the month with The Battler doing some heavy lifting - the underlying index being down something closer to 9%:

I have used the relevant ASX-listed Blackrock ETF (IVV) to approximate the AU$ move in the index (note that there was a small distribution paid on this instrument on 1 April):

What a change from a bit over a year ago now:

The All Ords Accumulation index was essentially flat for the month - saved by our enormous weightings to mining / energy.

Heavily Short ASX-listed stocks: April edition

Notable news items in relation to heavily-shorted ASX listed stocks for the month of April:

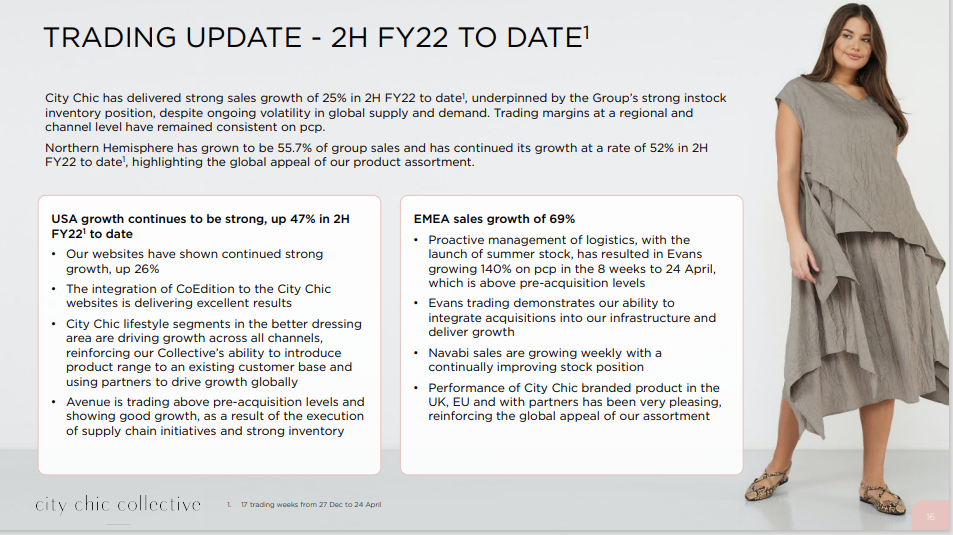

City Chic (ASX: CCX)

After falling for most of the last six months or so on the back of a number of concerns (including the resignation of a well-respected CFO, valuation and inventory build), City Chic released an update that was received favourably by the market.

General chatter from the bears that I have spoken to has centered around the update not dispelling concerns around inventory build, while bulls have pointed to sales numbers as an indication that the inventory situation will be resolved in the near term. This will be a very interesting June half update to watch out for.

Broker revisions that we saw were generally to the downside:

Short interest (according to www.shortman.com.au) was around 4% heading into the announcement. There currently appears to be a longer than normal delay in the data here, and it will be interesting to see what the reaction of shorts in aggregate was when it is updated:

https://www.shortman.com.au/stock?q=ccx

City Chic has also appointed EY as their new auditor, replacing Deloitte after a decade:

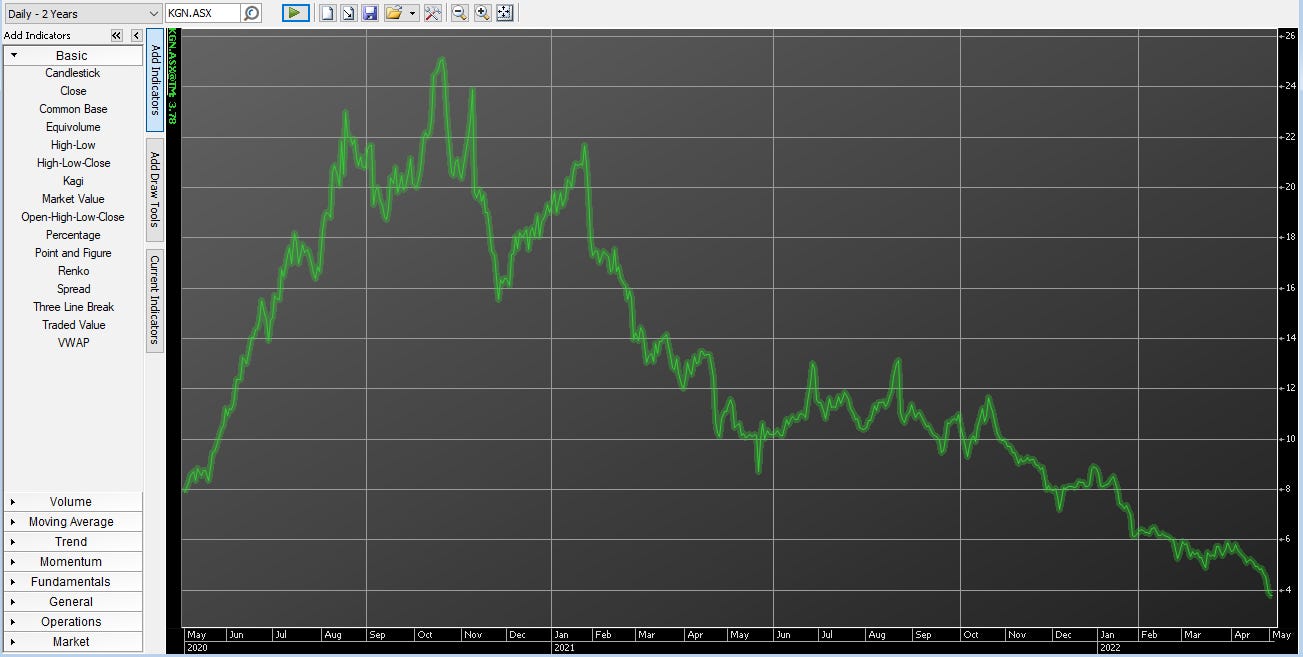

Kogan.Com (ASX: KGN)

Kogan.Com continued its ~18 month long slide from COVID-related highs, culminating in another poorly received market update on 29 April. The stock is now the lowest it has been since March 2020.

Elevated costs, declining sales and inventory issues continue to feature:

It’s hard to see these options getting back in the money any time soon:

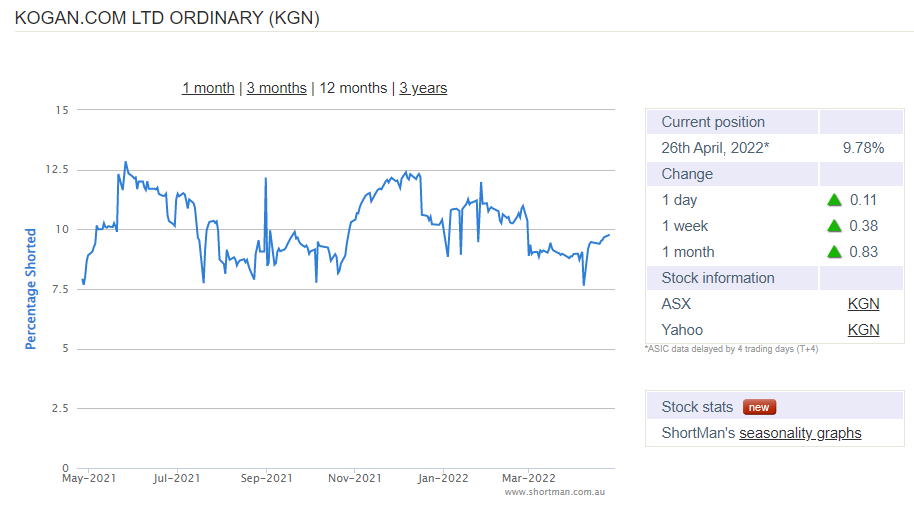

Short interest remained elevated towards the end of April, however as above the current lengthy delay for up-to-date data means that we will have to wait to see how short sellers reacted to the update:

https://www.shortman.com.au/stock?q=kgn

EML Payments (ASX: EML)

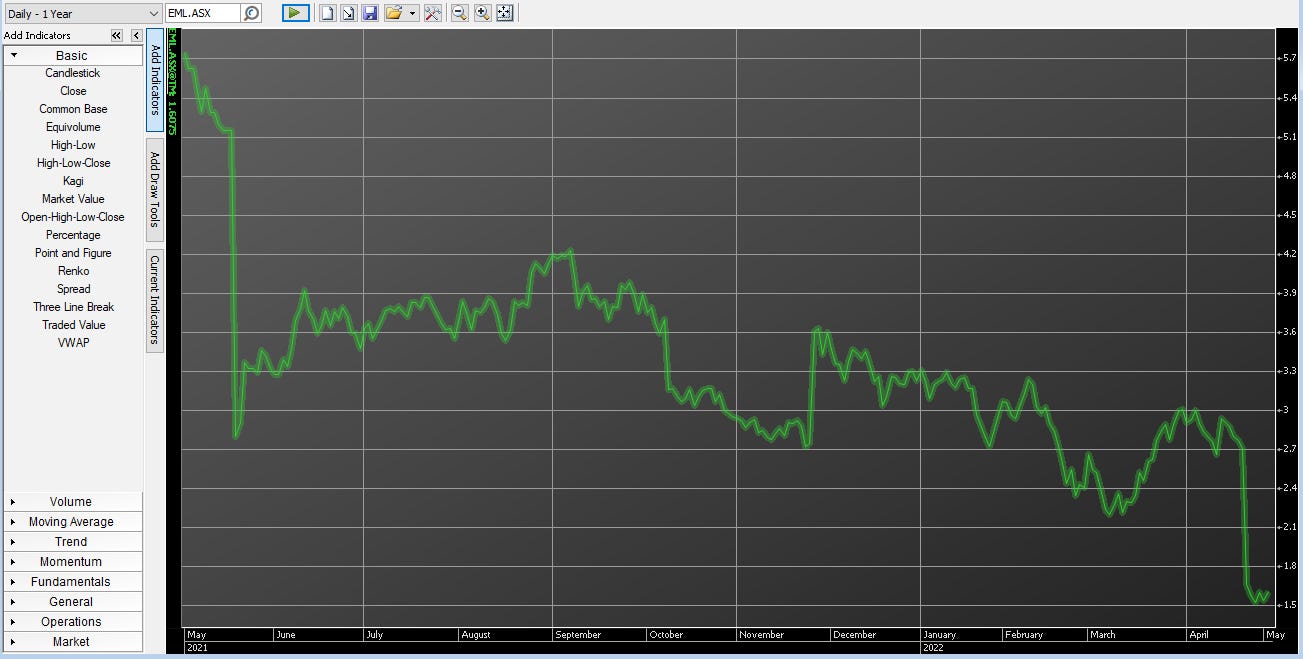

EML Payments released a poorly received guidance update at the recent Goldman Sachs Emerging Leaders Conference, continuing the theme of the last year post the revelation of issues (primarily regulatory) in the company’s European operations.

Elevated costs and crimped sales stemming from increased regulatory oversight saw the stock knocked ~40% on the day:

Certain high-profile bulls and brokers continue to point to the prospect of significantly improved profitability should interest rates remain elevated. Bears continue to point to the multitude of issues in the company’s PFS subsidiary (not just with respect to the Central Bank of Ireland investigation), insider selling and executive departures post the acquisition.

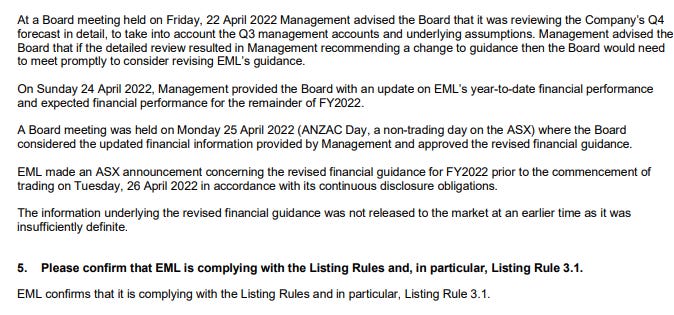

The company was subsequently issued with a ‘please explain’ from the ASX, with the crux of their response as follows:

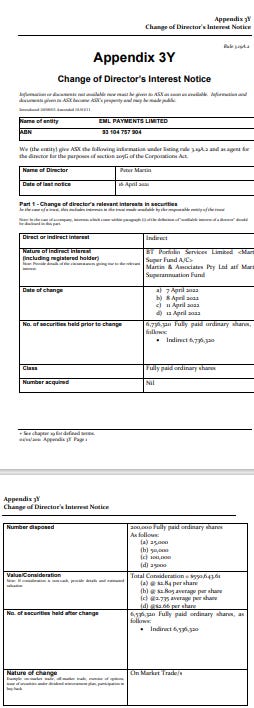

Of particular note when speaking to both bulls and bears was the chairman selling stock <2 weeks prior to the downgraded guidance:

Short interest has recently risen sharply, however as above the current lengthy delay for up-to-date data means that we will have to wait to see how short sellers reacted to the update:

https://www.shortman.com.au/stock?q=EML

ZIP Co (ASX: ZIP)

The BNPL sector remained a winner for short sellers in April, with top-10 ASX short ZIP (previously ASX: Z1P - the change in ticker code does not appear to have helped the situation) continuing to take a shellacking.

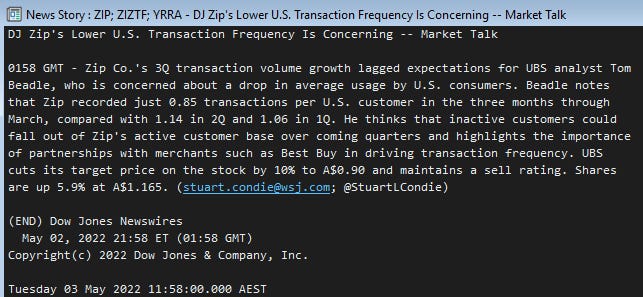

The company provided a quarterly update during the month. UBS analyst Tome Beadle must be feeling something of a sense of relief if not outright vindication with respect to the fundamentals of most if not all of the BNPL players these days:

The business is currently progressing towards a merger with fellow ASX-listed, North American focused Sezzle Inc (ASX: SZL). Both companies now appear to be in cost cutting mode as growth has slowed and business economics have deteriorated (bad debts) as consumer-focused stimulus rolls off.

Top 10 most shorted

The current top 10 most shorted stocks according to www.shortman.com.au are as follows. Please note the delayed data set being used here:

https://www.shortman.com.au/top

Around the grounds

Old Blue Sky Alternatives sparring partners John Hempton and Tony Boyd were at it again:

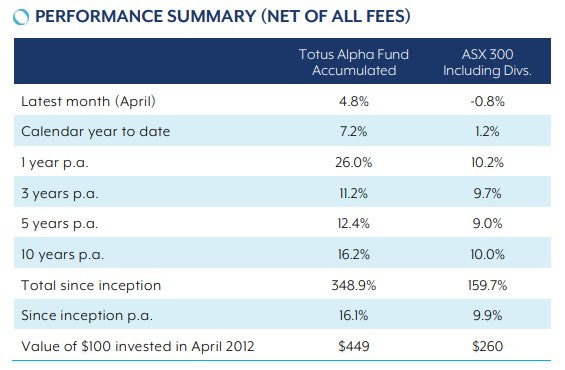

Ben McGarry is seeming quite chipper after a strong run of performance:

https://www.totuscapital.com.au/totus-alpha-fund/#performance

Update: Ben McGarry has just Tweeted out performance figures through until the end of April 2022 and they are spectacular. Well done to Ben and the Totus team.

L1 Capital are back at the top of the tables:

Viceroy Research (which includes Melbourne-based Gabe Bernarde) continued their activist campaign against German real estate group Adler:

The story has kicked up a notch post the end of April:

https://www.ft.com/content/ebd38553-50b6-4ab5-9e9d-8cd3d9a357ab

Disclaimer

The correctness of information on this site cannot be guaranteed. This site is for informational purposes only and should not be used for any other purpose, including but not restricted to providing financial advice, decision making or any other purpose. All information is provided "as is" without warranty of any kind, including implied warranty or fitness for a particular purpose.

The information on or produced from this site is in no way to be considered financial advice.

Limitation of Liability

UNDER NO CIRCUMSTANCES SHALL THE OWNER OR ANYONE CONNECTED TO THIS SITE BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL, OR EXEMPLARY DAMAGES THAT RESULT FROM THE USE OF, MISUSE OF, INABILITY TO USE, OR RELIANCE UPON THIS WEBSITE OR THE MATERIALS, INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOSS OF USE, DATA, BUSINESS OPPORTUNITIES, OR PROFITS. THIS LIMITATION APPLIES WHETHER THE ALLEGED LIABILITY IS BASED ON CONTRACT, TORT, NEGLIGENCE, STRICT LIABILITY, OR ANY OTHER BASIS, EVEN IF THE PERSON OR PERSONS INVOLVED HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGE. SUCH LIMITATION SHALL APPLY NOTWITHSTANDING ANY FAILURE OF ESSENTIAL PURPOSE OF ANY LIMITED REMEDY AND TO THE FULLEST EXTENT PERMITTED BY LAW.