Auto sector snapshot

This week I have simply noted down recent events in the ASX listed automotive sector given some recent news out of ARB.

I will generally try to keep these factual but are happy to publish insights and opinion as long as they are based on (1) public information; and (2) not overly speculative and / or emotive.

The below edition is substantially observation-only and acts as my own high-level record / diary.

As always I would love your feedback and input.

Around the traps: Notable long / short performance figures

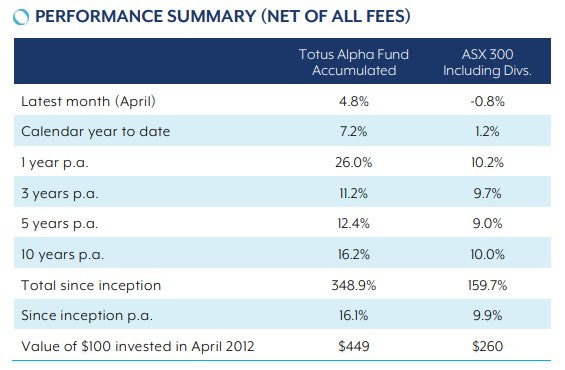

Following on from my previous notes, Totus has had an absolute scorcher:

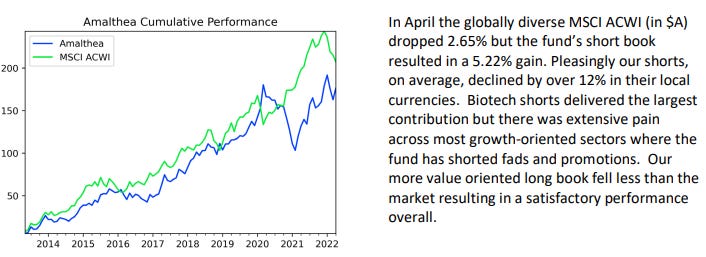

Bronte also had a decent month and has been bouncing back strongly from the meme-mania and general silliness of the 2020 / 2021:

Alium commendably managed to hold things together in a rather brutal market:

These are just a sample of the Aussie-based (although not necessarily ASX-focused) long / short managers that I follow.

Auto sector: ARB update

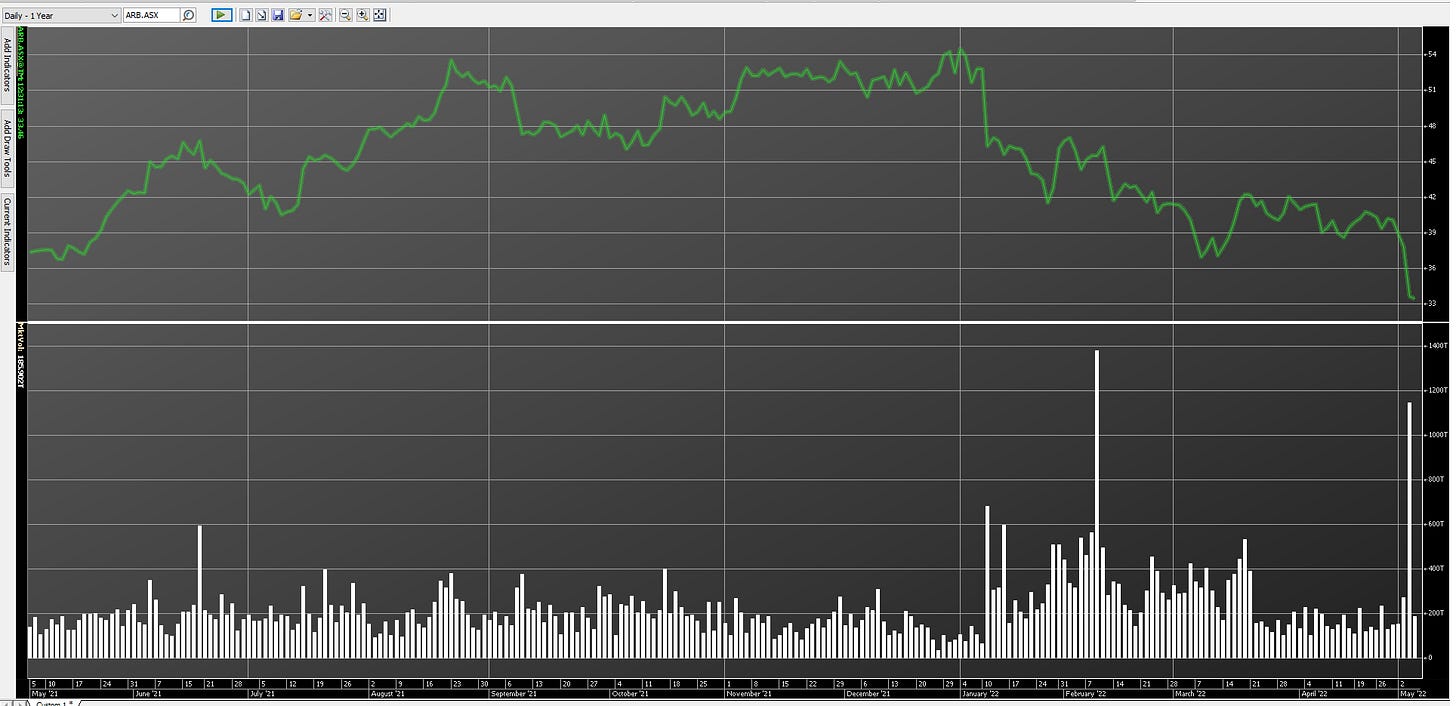

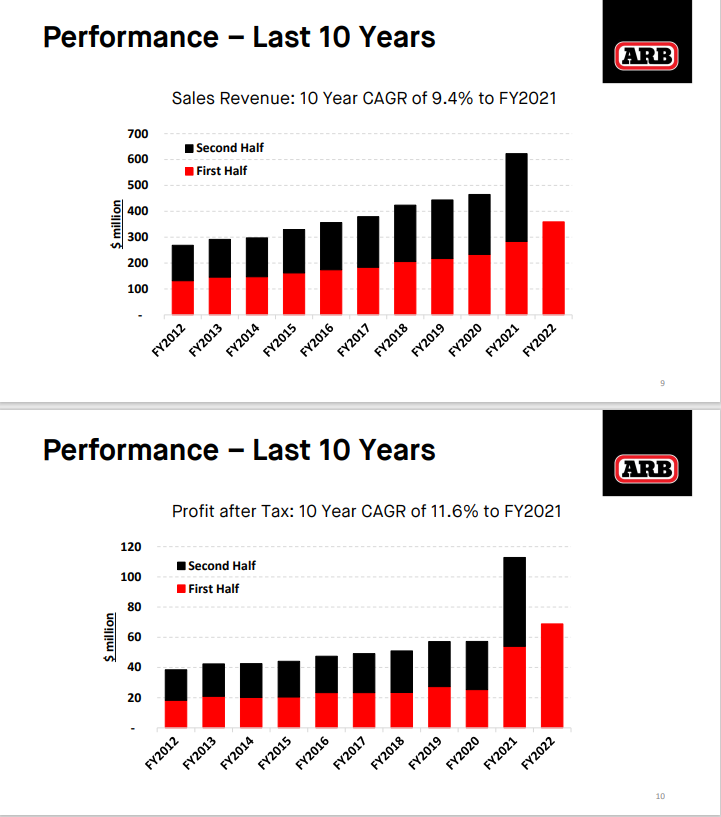

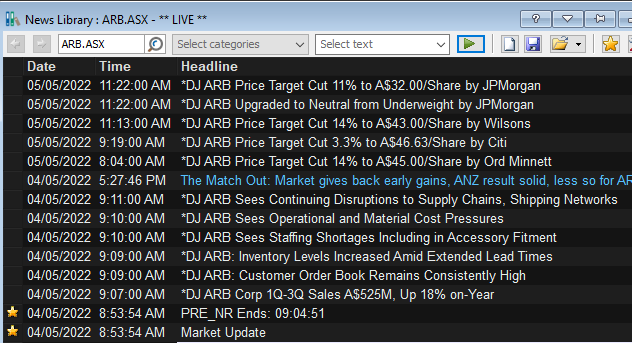

Branded 4WD / SUV accessories manufacturer and distributor ARB Corporation released an update on 4 May that included slightly softer than consensus guidance and commentary around supply-chain related delays to sales and increased costs. The update was received negatively by the market, with the stock down around ~11% on the day.

The stock has been sliding since late December 2021 on concerns around consumer discretionary spend / the automotive sector outlook and valuation:

Short interest is currently near 12 month highs but remains relatively low (note that this data is delayed), and also fell post the update:

https://www.shortman.com.au/stock?q=arb

Speaking to bulls and bears, bears emphasised the extremity of the ‘COVID bump’ to sales and a general view that analysts have capitalised this increase in sales and earnings to too high a degree.

Bulls noted ARB’s management typically being conservative in their commentary. The company emphasised in the update that upcoming refreshes and delays to deliveries of key new vehicle models (e.g. LandCruiser 300 Series, 2022 Ford Ranger) are currently acting as a handbrake, but that the “customer order book remains consistently high”.

A number of bears that I spoke to noted that they are not convinced that this sales pipeline will fully convert to sales given weakening macroeconomic conditions and the recommencement of global travel diverting discretionary spend.

Broker reactions to the update that I saw were primarily to the downside:

I have observed that the company / management team is generally admired, so I would be surprised to see a significant ramping up of short interest in the stock in isolation. The modest short covering on the negative share price reaction to the update seems qualitatively understandable on this front.

The update and share price reaction did prompt me to go and take a look around the ASX-listed auto sector more broadly which I have not done in a while. Observations below.

Auto sector: Rising short interest

Eagers Automotive (ASX: APE, formerly AP Eagers) short interest has risen in recent months and now stands near multi-year highs:

https://www.shortman.com.au/stock?q=ape

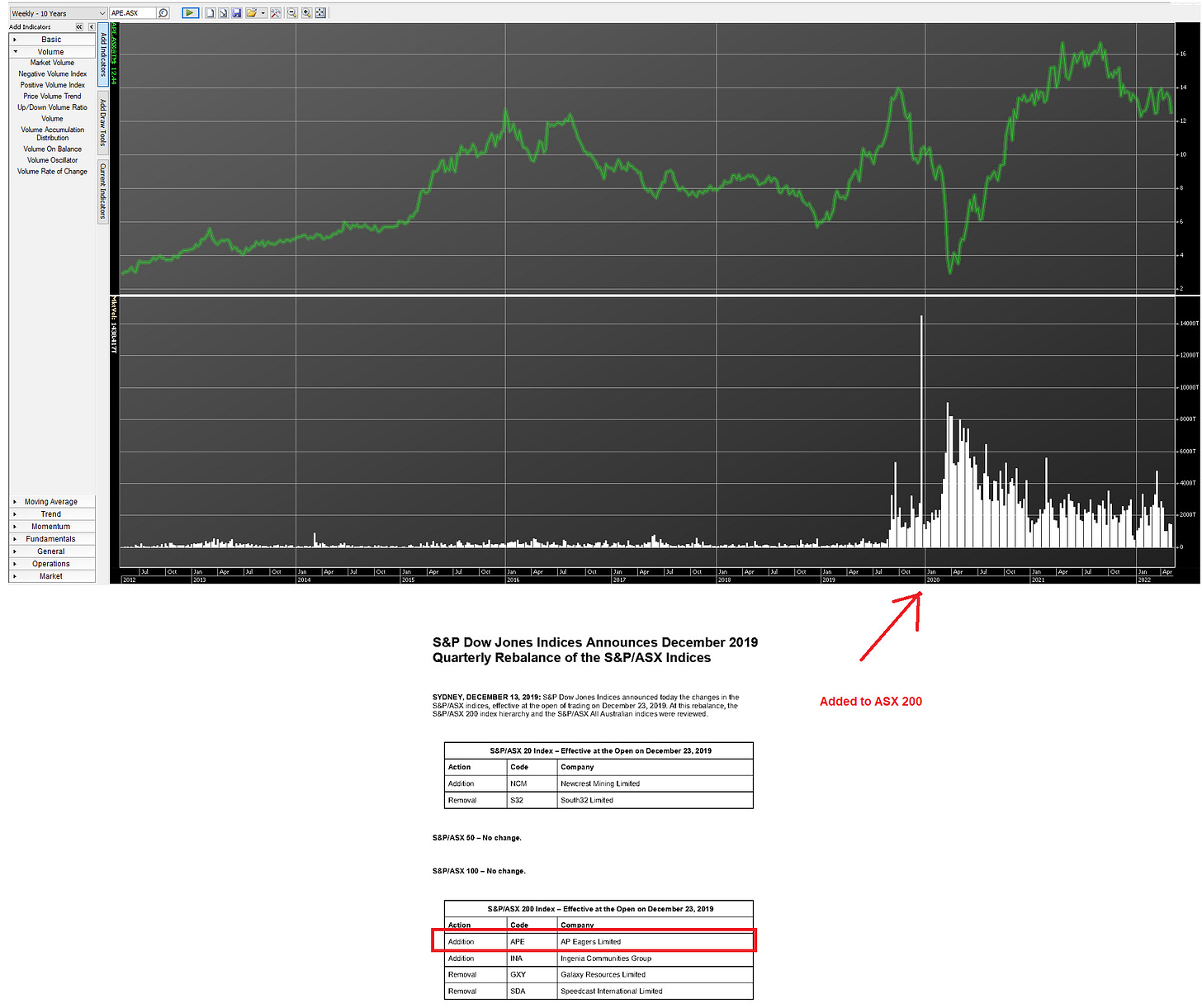

The stock has been quite volatile in the past around general macroeconomic conditions. I also note the dramatic change in the volume of turnover / liquidity in the stock in recent years following the merger with / acquisition of Automotive Holdings Group and subsequent addition to the ASX200 index:

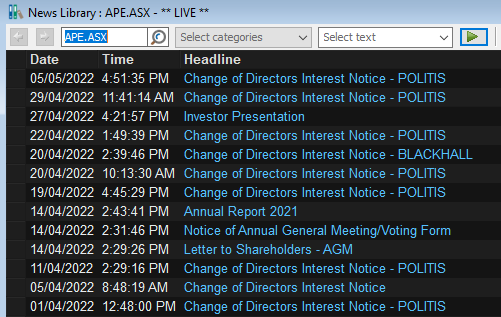

There has been repeat recent insider buying (including by the largest shareholder). I am not going to pass judgement on the subjective significance of the quantum of purchases. That’s up to you to evaluate:

Less discretionary automotive sector stocks

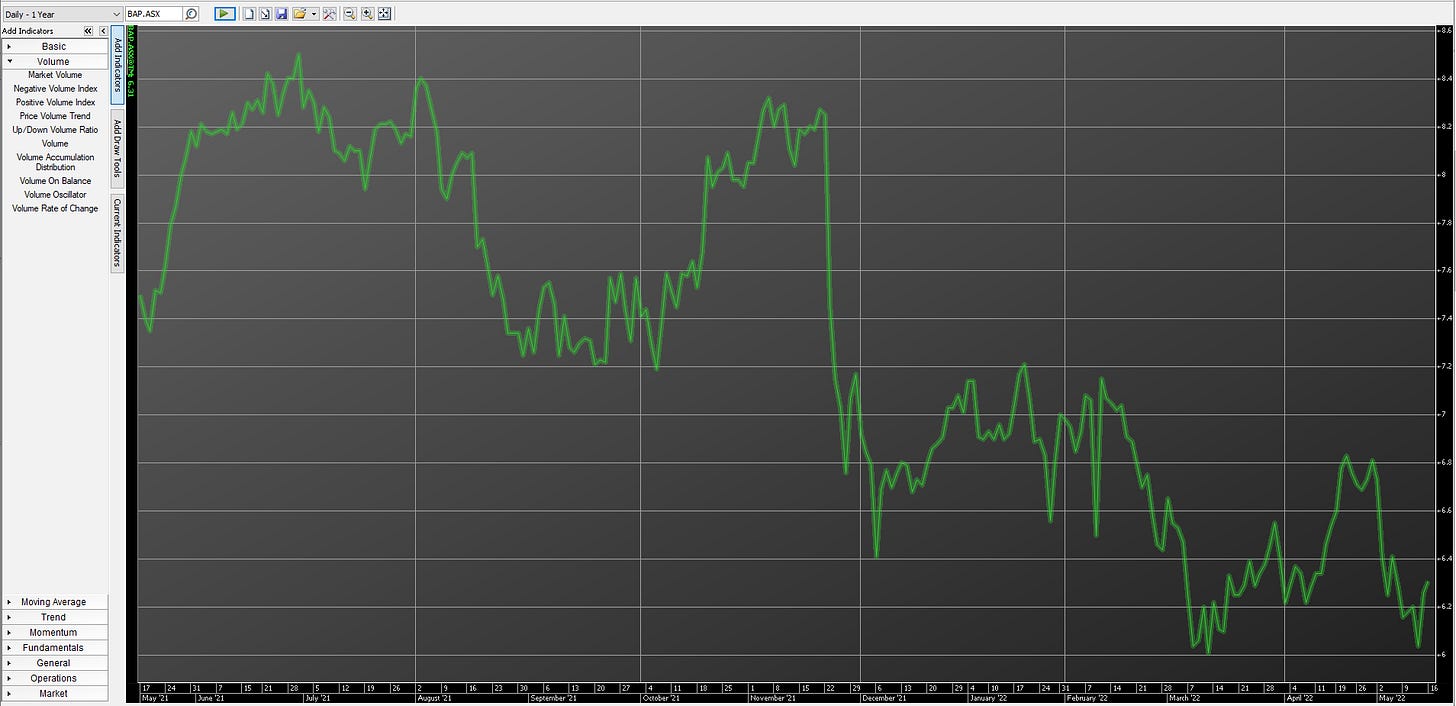

Other automotive sector stocks of a less discretionary nature (with respect to consumer spending) have also seen rising short interest and weak stock price performance in recent months. Roll-up story Bapcor (ASX: BAP) stands out given recent executive turnover:

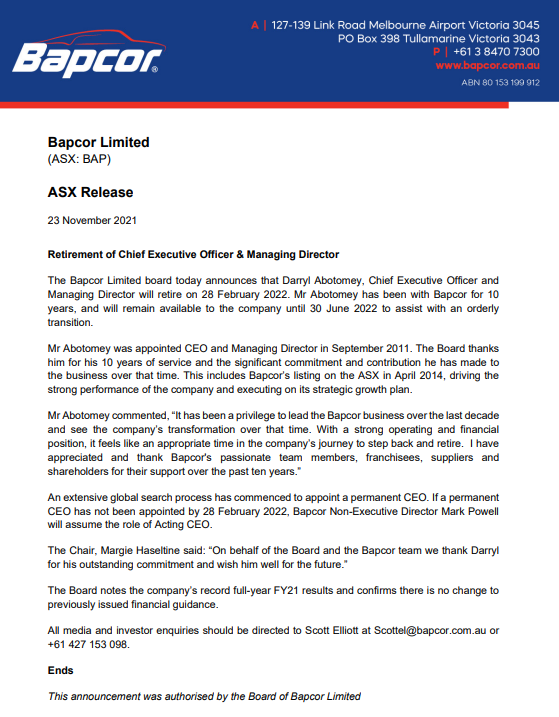

Initially it was announced that the CEO would be retiring by the end of February:

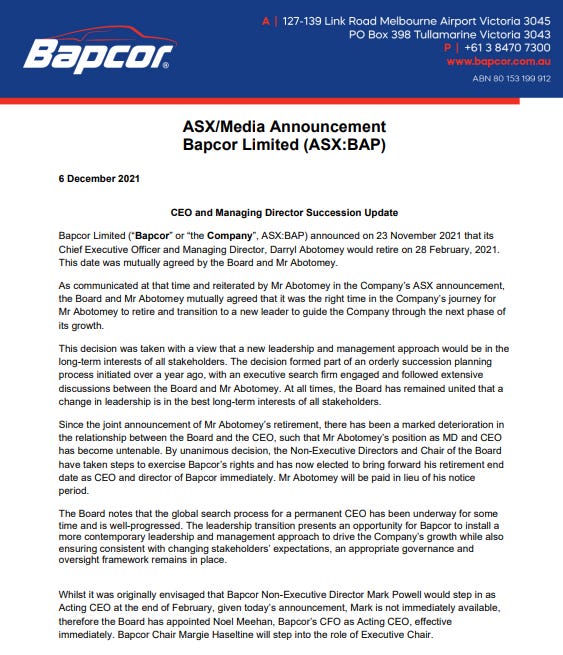

This was followed by news that the CEO’s departure was being brought forward as a result of a deterioration of their relationship with the board:

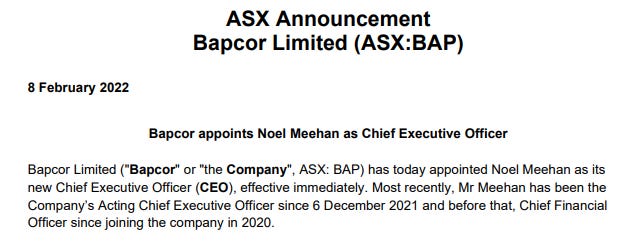

The company has subsequently appointed acting CEO Noel Meehan to the role on an ongoing basis:

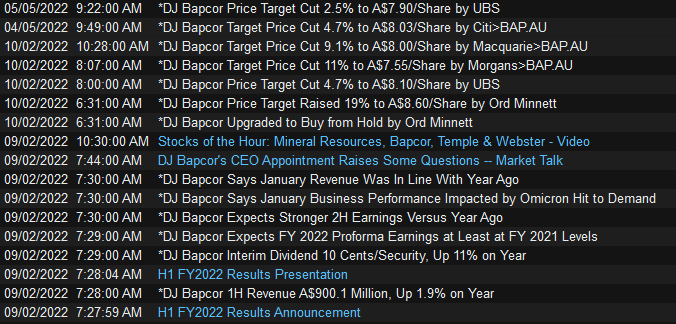

Broker revisions I have seen following the first half FY22 results were generally to the downside:

Reaction to the companies recent Macquarie conference presentation appears to have been modest:

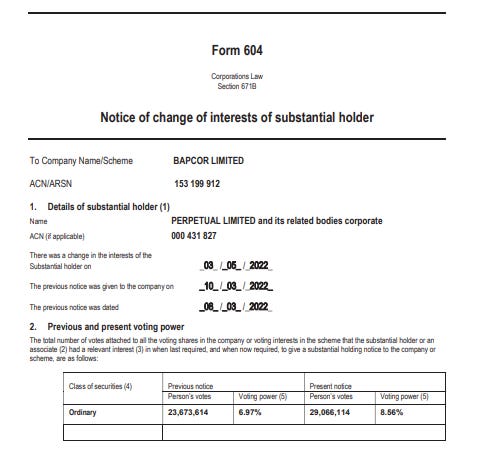

Perpetual increased their existing stake:

Given the somewhat roll-up nature of the BAP story, that it largely sells less discretionary products and the events around the departure / replacement of the CEO roll, it is perhaps a little difficult to ascribe the recent rise in short interest to a generally weakening view around the auto sector more generally. I will be keeping an eye on this story.

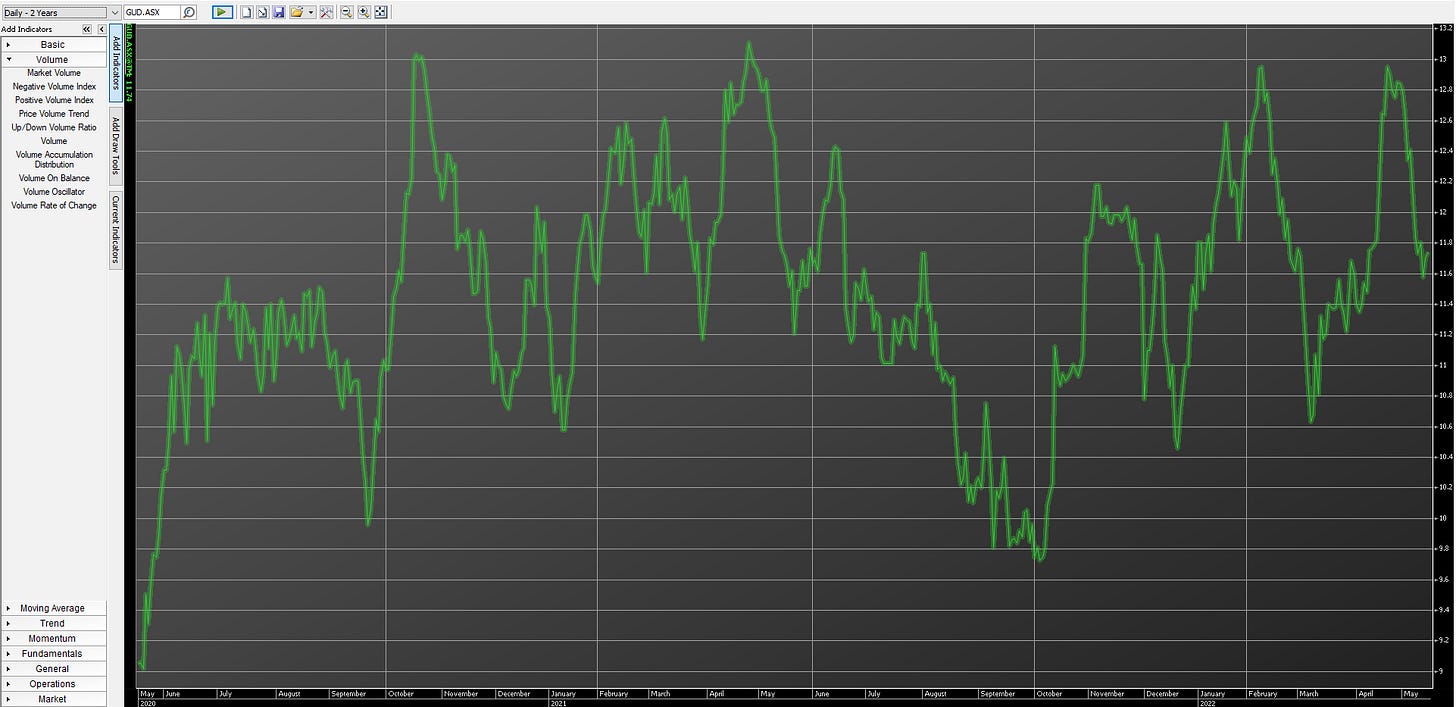

Elsewhere, automotive aftermarket filters / braking components and other automotive accessories distributor GUD has recently seen an uptick in short interest. I haven’t managed to speak to anyone who is short, or even anyone who is just either particularly bullish or bearish. Go figure. The stock has been choppy in a range for the last couple of years:

https://www.shortman.com.au/stock?q=gud

Speaking to peers, chatter on the stock was largely around the potential for supply chain / inventory related issues and cost pressures.

Smaller automotive names

In some smaller, more discretionary automotive sector stocks (but extremely tightly held, with limited borrow availability and short interest), stock price performance in recent months has been generally soft.

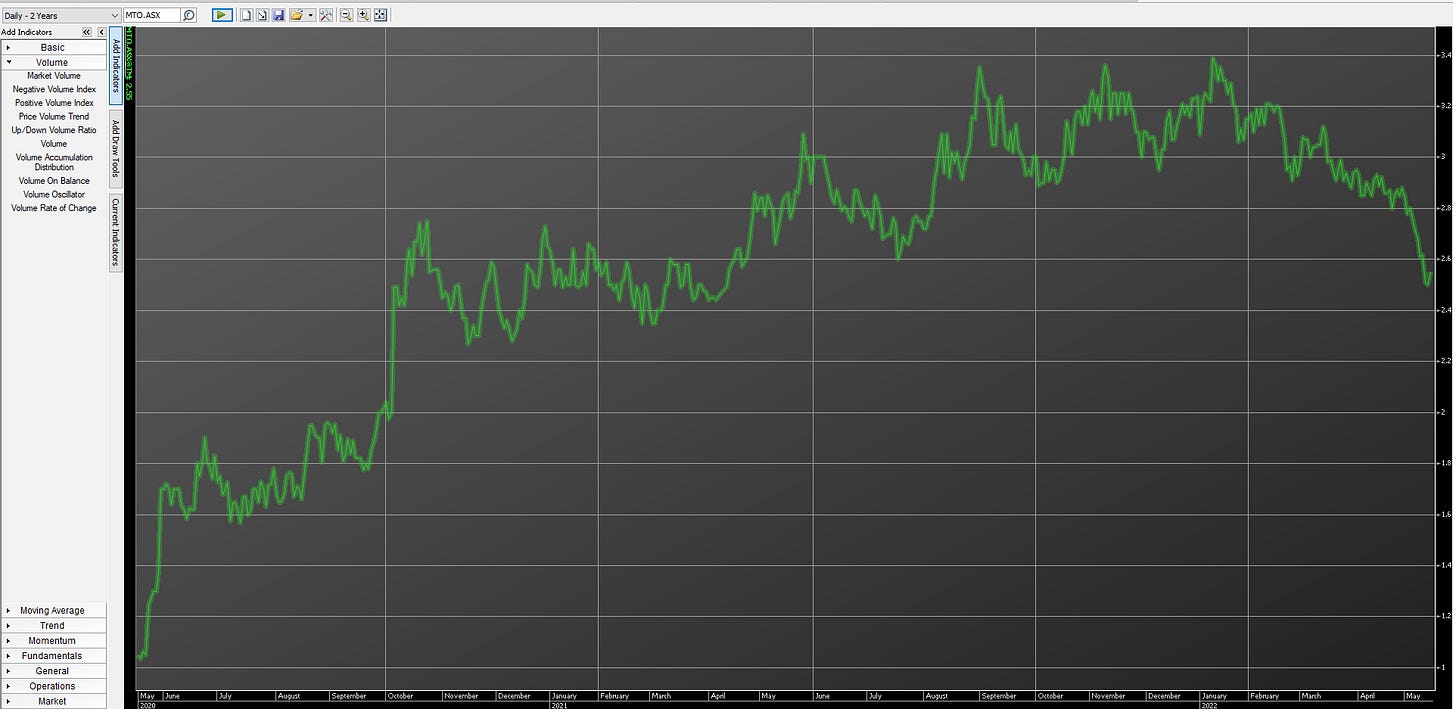

Motorcycle Holdings Limited (ASX: MTO):

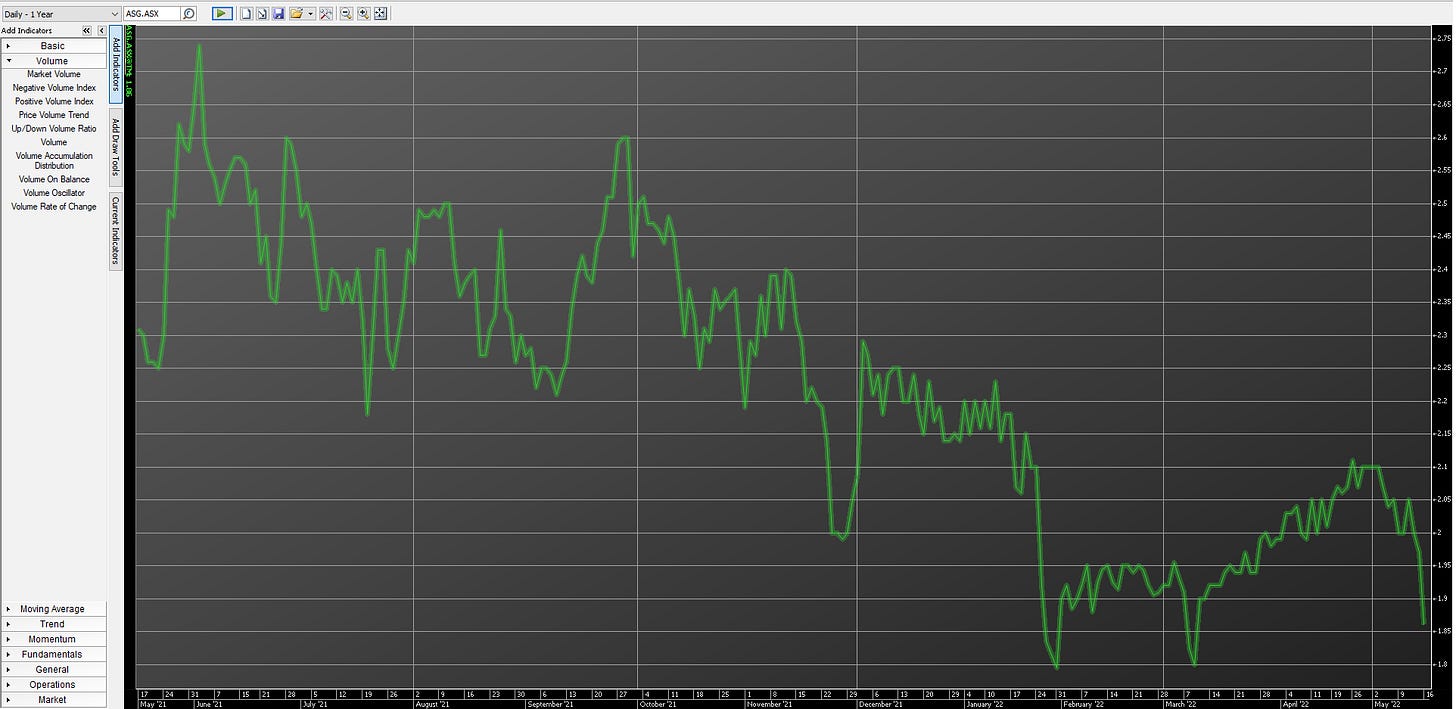

Autosports Group (ASX: ASG):

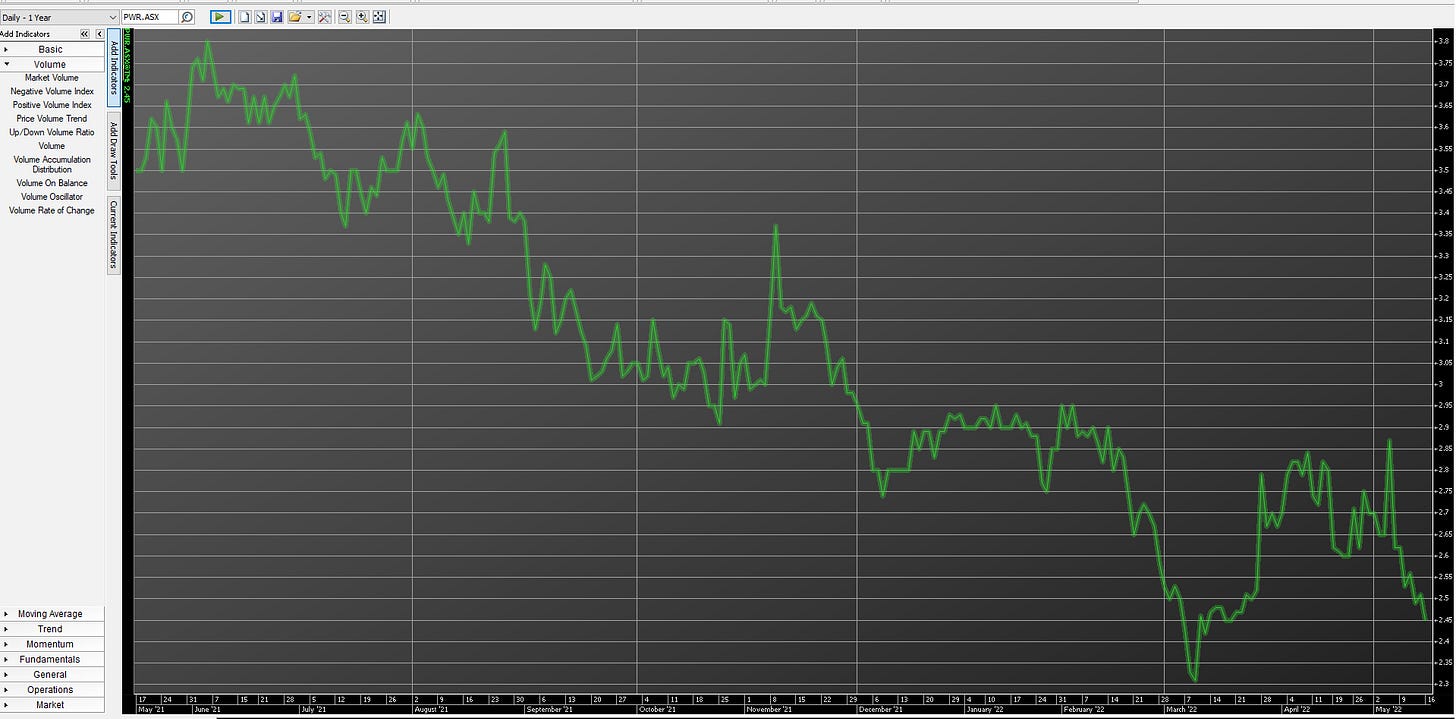

Peter Warren Automotive Holdings (ASX: PWR)

Overall, it seems that a combination of fairly generic concerns regarding discretionary spend on new and used autos / accessories, supply chain issues and cost pressures (an issue for a much broader set of businesses than just the auto sector) is leading to increasing short interest across the sector.

Other notable consumer discretionary spend exposed names

Similar concerns and trends in short interest apply to certain other consumer discretionary spend exposed names. As above, a combination of economic slowdown, supply chain and cost pressure issues are feeding into the discussion.

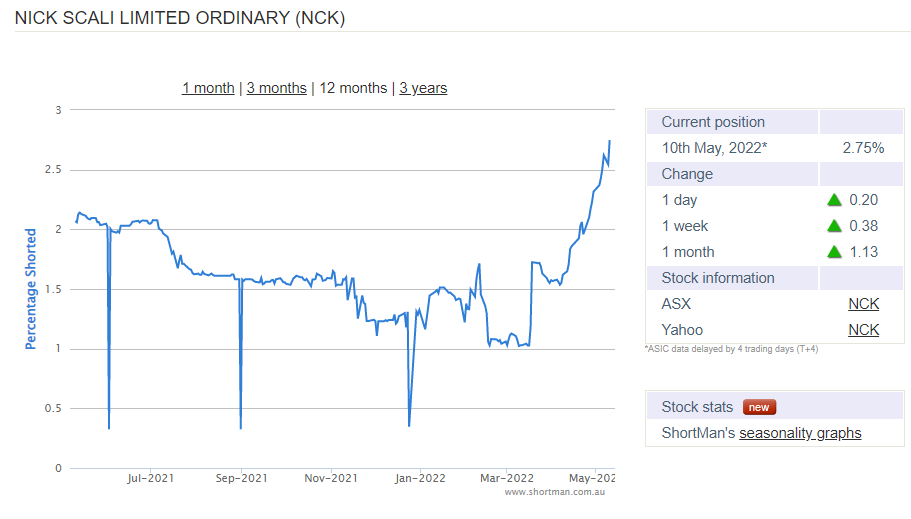

Nick Scali (ASX: NCK)

https://www.shortman.com.au/stock?q=nck

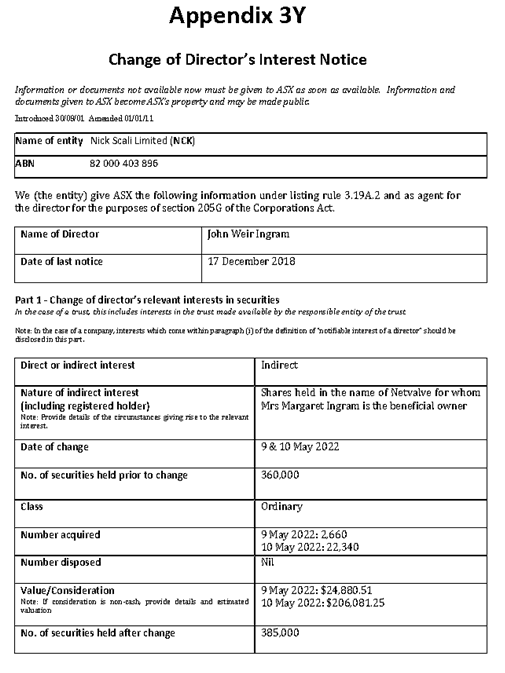

There has been some modest recent insider buying in NCK:

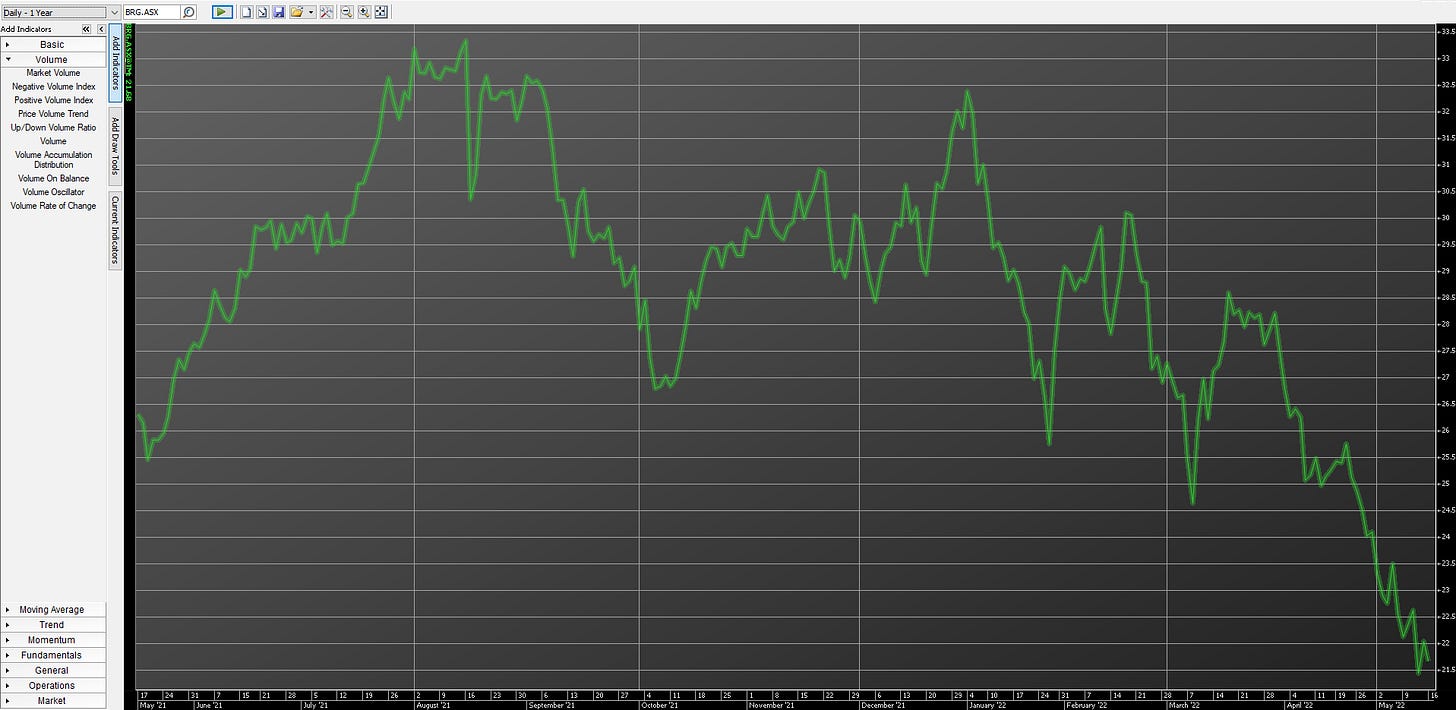

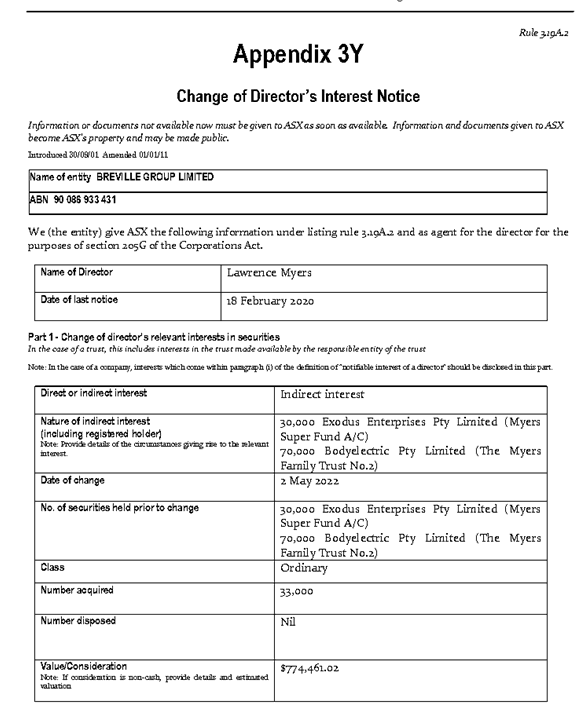

Breville Group (ASX: BRG)

https://www.shortman.com.au/stock?q=brg

Note that the stock recently initially reacted positively to, and the short interest reported above fell, proximate to a presentation at the Macquarie Investor Conference. Prior guidance was reconfirmed in the update:

The stock has subsequently continued to sell off as it has (with a lot of volatility) since August 2021:

There was also subsequently an insider purchase of ~$774k worth of stock:

The date of this purchase apparently the day before the presentation for the Macquarie Investor Conference was lodged with the ASX.

Other items

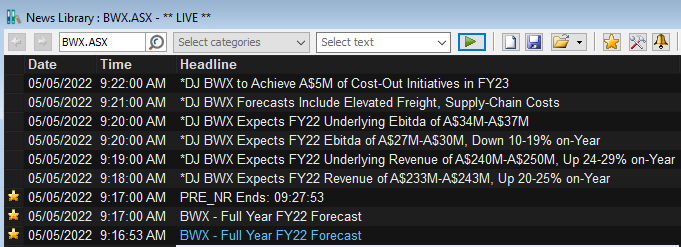

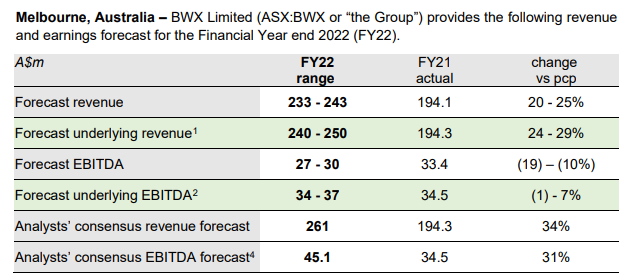

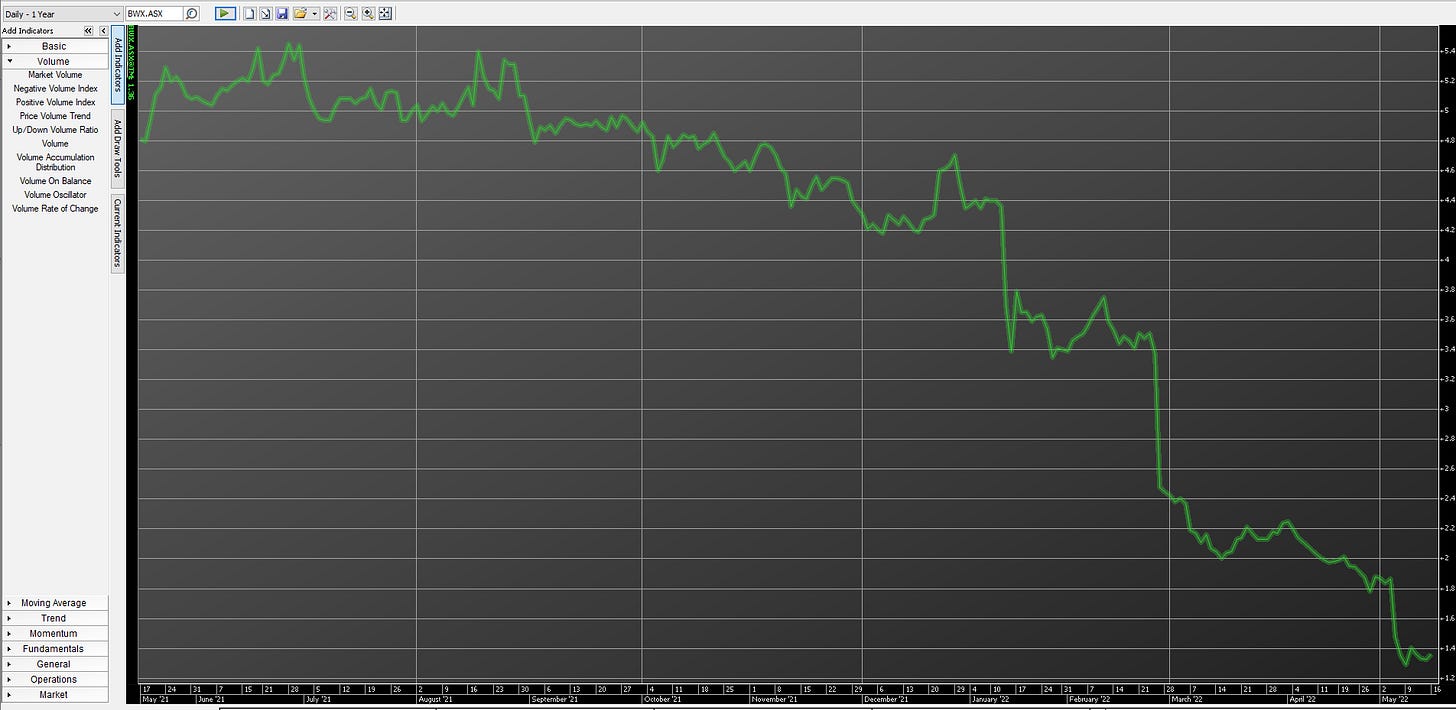

BWX (ASX: BWX) downgraded guidance for FY22

BWX has seen sharply rising short interest in recent months and the stock has been belted since around September 2021, with significant falls in January 2022 (CEO transition) and February 2022 (half year results):

https://www.shortman.com.au/stock?q=bwx

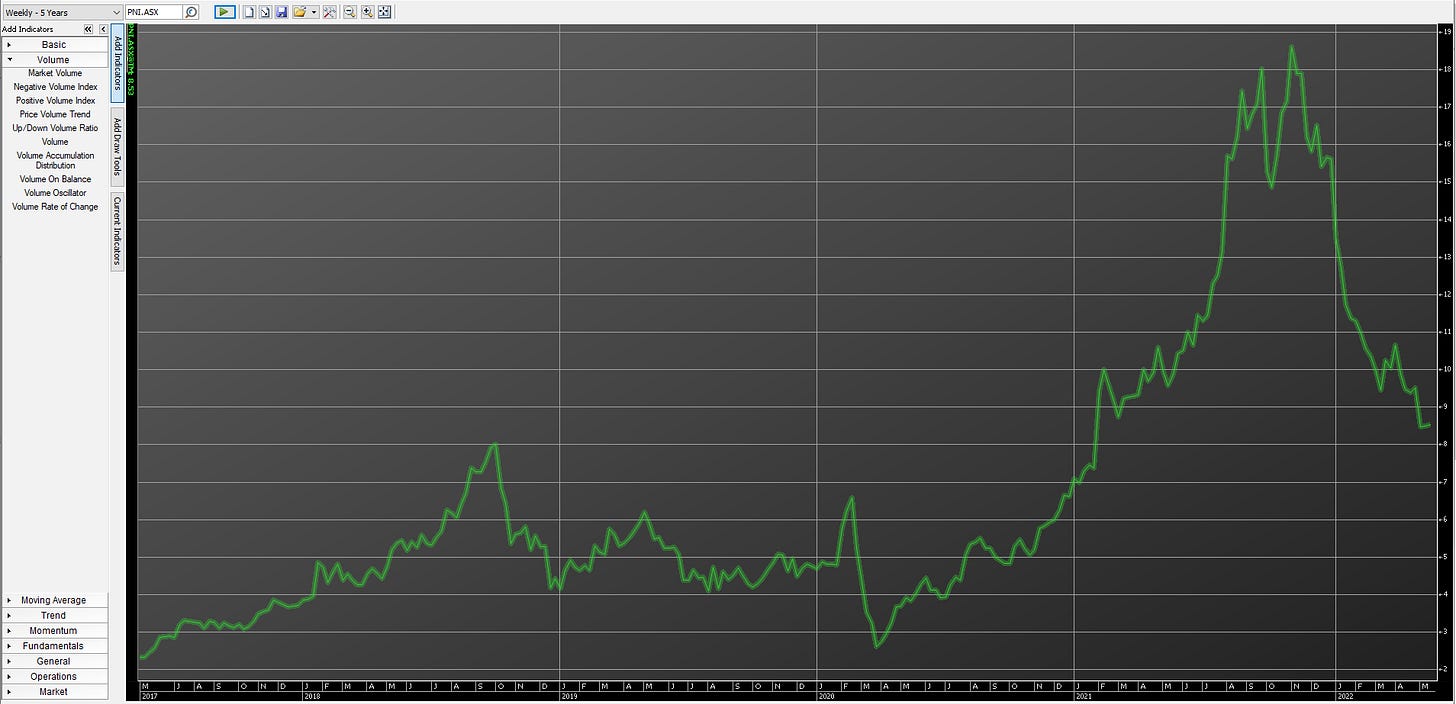

Pinnacle Investment Management (ASX: PNI): Sharply rising short interest

Short interest in multi-affiliate funds management back office / marketing / distribution and co-owner Pinnacle Investment Management Group has ramped up in recent months, coinciding with general weakness in liquid asset markets a run of poor performance at some of their higher profile affiliates such as Hyperion.

The stock peaked at $19.29 in November 2021 near the height of the growth-stock bull run and was trading at $8.53 at the time of writing (-56%):

https://www.shortman.com.au/stock?q=pni

Rising short interest in listed asset managers appears to be a general theme across the ASX (e.g. MFG, PDL - currently the subjective of a takeover proposal, PTM), although I acknowledge that there a range of issues as play here including industry trends, underlying asset exposure, performance and fee hurdles.

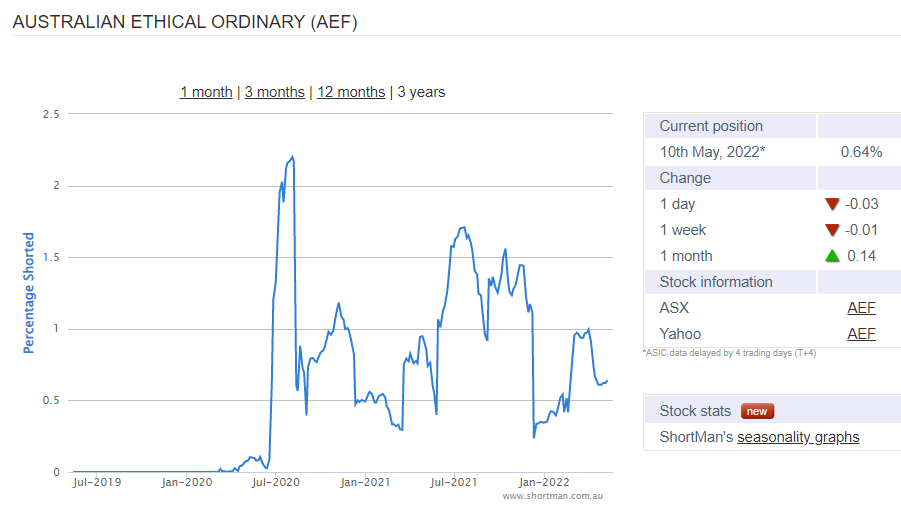

Another name that I am watching given it has been a reasonably good indicator of the level of ‘exuberance’ in the Aussie market over recent years is Australian Ethical Investment Limited (ASX: AEF). It has had a wild ride, traded on extraordinary multiples but also executed well and grown FUM (including in unconventional and seemingly cost-effective ways: https://www.afr.com/companies/financial-services/christian-super-to-merge-with-australian-ethical-20220406-p5ab77):

Short interest remains low and I have heard that borrow has been historically quite limited:

Thanks for reading.

Cheers

@ShortBookNotes

Disclaimer

The correctness of information on this site cannot be guaranteed. This site is for informational purposes only and should not be used for any other purpose, including but not restricted to providing financial advice, decision making or any other purpose. All information is provided "as is" without warranty of any kind, including implied warranty or fitness for a particular purpose.

The information on or produced from this site is in no way to be considered financial advice.

Limitation of Liability

UNDER NO CIRCUMSTANCES SHALL THE OWNER OR ANYONE CONNECTED TO THIS SITE BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL, OR EXEMPLARY DAMAGES THAT RESULT FROM THE USE OF, MISUSE OF, INABILITY TO USE, OR RELIANCE UPON THIS WEBSITE OR THE MATERIALS, INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOSS OF USE, DATA, BUSINESS OPPORTUNITIES, OR PROFITS. THIS LIMITATION APPLIES WHETHER THE ALLEGED LIABILITY IS BASED ON CONTRACT, TORT, NEGLIGENCE, STRICT LIABILITY, OR ANY OTHER BASIS, EVEN IF THE PERSON OR PERSONS INVOLVED HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGE. SUCH LIMITATION SHALL APPLY NOTWITHSTANDING ANY FAILURE OF ESSENTIAL PURPOSE OF ANY LIMITED REMEDY AND TO THE FULLEST EXTENT PERMITTED BY LAW.